Tips On Talking To Your Kids About Money Matters

Encourage them to start saving at a young age

Ms Esther Tan, her children Nathan and Phoebe Foong, and Mr Elvin Foong at their home on Jan 21, 2019. PHOTO: ARIFFIN JAMAR/THE STRAITS TIMES

ST How to talk to your kids about money matters

For Chinese New Year last year, Ms Esther Tan and her husband allowed their children to spend three $2 notes from the hongbao (red packet) money they collected.

Nathan, aged seven, and Phoebe, five, were each allowed to buy three $2 items of toys and stationery from the Daiso store, while their parents saved the rest of the money for them.

The family has found that using notes in small denominations is a tangible, effective way to teach young children about money.

"It's about breaking down financial concepts, such as saving and spending, so kids can understand, using scenarios that are close to their heart," says Ms Tan, 33.

She and her husband, Mr Elvin Foong, 36, are co-founders of The Treasure Box SG, an online site that sells Christianity-based products and services targeted at families.

More complicated uses of money are challenging to explain. When the couple took their offspring to the bank to deposit their hongbao cash, the kids wondered why the money was being "taken away".

With Chinese New Year around the corner, parents may be mulling over how to guide their children when it comes to hongbao money and other aspects of financial literacy.

One recommendation is to set age-appropriate expectations before the festive visiting begins, says Mr Vipin Kalra, chief executive officer of BankBazaar Singapore, an online marketplace that helps consumers compare and apply for financial products, such as credit cards and personal loans.

He suggests that parents ask pre-schoolers to hand over their red packets to them, allowing them to save the money on their behalf. Primary school children can be given the responsibility of holding onto their hongbao collection during the festive period to keep track of how much they receive.

Those in secondary school and older can be given the freedom to decide how they wish to use the red packets, whether to save, spend or donate the money, says Mr Kalra, adding that this would also provide an opportunity to introduce older children to the concept of investments.

Experts recommend broaching the topic of money before children reach Primary 1, when they typically receive an allowance for school.

Related article: 5 Basic Steps To Retirement Planning For Young Couples

Ms Ng Hau Yee is director of Junior Achievement (Singapore), which runs programmes in schools focused on educating students about work readiness, entrepreneurship and financial literacy. She says: "It is important to start financial literacy education (from as young as four to five years old) to cultivate good financial habits. How a person feels about money stems from what he is exposed to, from the time he is a kid."

She suggests that parents can begin teaching pre-schoolers about concepts such as earning, spending and saving, for instance, by taking them to the market to learn about trade and the exchange of money.

Another important financial concept that children should learn, by the time they reach lower primary age of between seven and nine years old, is distinguishing needs and wants, says Ms Ng.

Parents can guide their children through the family's purchasing decisions. For instance, vegetables, fruit and milk are needs, chocolate is what you might want, she says.

Ms Tan and Mr Foong say that teaching about finances is also a way to impart family values.

For example, when their son Nathan had a birthday late last year, they asked him to set aside about $300 from his birthday hongbao to offset part of the cost of a buffet they had catered for his party.

When his parents told him their rationale, he understood the gesture as "returning the love" of relatives and friends at his party by giving them a treat, says Ms Tan.

In addition, when Nathan wants to give to charity, such as by contributing to donation tins for flag days, Ms Tan might give him some of her spare change, but she takes the same number of coins from his piggy bank when they get home.

Mr Foong says this helps Nathan to understand concepts such as "nothing is free" and that money can be used to benefit others.

Other ways of teaching children financial literacy can be through compartmentalising expenses and playing board games, says Ms Angeline Wee, 48, who works in a statutory board.

Related article: 54 Ways To Save And Get Savvy With Your Money

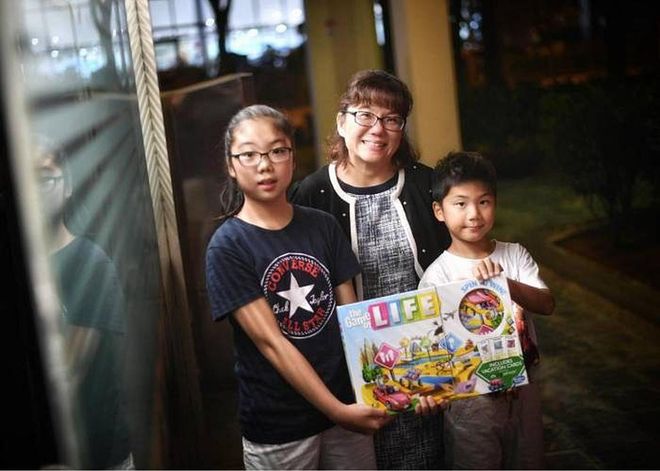

Ms Angeline Wee (centre) teaches her children Janelle (left) and Noel Foo financial literacy through board games like Life. PHOTO: ARIFFIN JAMAR/THE STRAITS TIMES

ST How to talk to your kids about money matters 2

She gives each of her three children a plastic container with dividers, which contain the $1.50 they each get every day for school.

"I don't give them too much pocket money so they are forced to make a choice, for instance, between getting a serving of canteen food or buying snacks and sugary drinks," says Ms Wee.

Her eldest daughter, Primary 6 pupil Janelle Foo, 11, also looks forward to playing The Game of Life with her parents and her two younger siblings, Noel, eight, and Estelle, 10. The board game portrays life journeys, with milestones such as marriage, children, jobs and retirement.

Janelle says it teaches her about the cost of a home and paying for vacations.

In Ms Ice Lee's family, the grown-up world is used to teach her children about earning money.

Ms Lee, 44, is an image professional in the beauty industry while her husband Louie Tai, 43, is a corporate training consultant. She used to tell Kenneth, nine, and Kathryn, five, that he had to travel for work to earn money for the household and encouraged their children to earn their own money. They are each given about $1 for doing one chore, such as sweeping the floor or washing the dishes.

The couple also encourage the children to save their money in piggy banks.

Mr Tai says: "It's important for children to be comfortable with money. You don't want them to be lavish, neither do you want them to be fearful of spending money.

"Money is really a tool. The concept of saving for instance, helps children think about and dream about the future."

Related article: 20 Ways To Stretch Your Dollar Right Now

TIPS ON HOW TO TALK TO YOUR KIDS ABOUT MONEY

Ms Skye Tan, a family life specialist at Focus on the Family Singapore, offers parenting tips on how to teach children about money.

How much to save, how much to spend?

With older children, consider using these guidelines: save 40 per cent, spend 40 per cent, give 20 per cent.

Parents may adjust the ratio depending on the age of the child.

Giving can mean supporting a charity or buying something for someone. We teach kids to share toys and to be kind but somehow we seldom extend these principles to money.

This helps teach generosity and guides the child to be more considerate of others.

Use jars or envelopes

With younger children, consider using labelled jars to manage their weekly savings, spending and giving.

It helps children to have a visual representation of where their money is going. If they are saving to buy something for themselves or someone else, parents can paste a picture of the item on the "savings" jar.

You can also use an envelope system for categories like food, entertainment and clothes. When your child handles cash and sees how much there's left every time he make a "withdrawal" from the envelopes, it teaches him his resources are finite. With your guidance, he can learn to budget better.

Track daily expenses

For primary and secondary school children with allowances, a useful way of helping them see where their money is going is to ask them to keep an allowance book to document their daily expenses.

After a while, show them the patterns you see and help them assess if they can cut out unhealthy spending or even eating habits.

Talk about your own budget

Model good financial habits for your children.

Let them see you doing the bills every month. Teach them how you portion out your income for bills and savings; think out loud when you shop together.

You could say: "I really like this bag but it's out of my budget. I'll come back next month and if it's on sale, I will get it. If it's not, that's okay."

These are little lifestyle habits that can teach children to think wisely about money.

This article originally appeared on The Straits Times.